Systematic SPX 14DTE Put Credit Spread Strategy

Write your awesome label here.

About this Course

Can't watch the market all day? Tired of credit spread trades where 1 loss wipes out 10 trades? Have a small account but don't know where to start? If the answer is yes to any of these questions, then this strategy may be a good fit for you.

There's a special focus on risk management and portfolio allocation so that you can easily evaluate how many spreads you should trade according to your account size and risk tolerance.

I'd put this strategy into the CrockPot style of trades. That is "Set It and Forget it".

This course will teach you how to trade this easy to execute strategy spending less than 30 minutes per week so that you can grow your account over time.

There's a special focus on risk management and portfolio allocation so that you can easily evaluate how many spreads you should trade according to your account size and risk tolerance.

Nobody else talks about this when it comes to options trading which is why I specifically built the risk management and portfolio allocation into the strategy itself.

I'd put this strategy into the CrockPot style of trades. That is "Set It and Forget it".

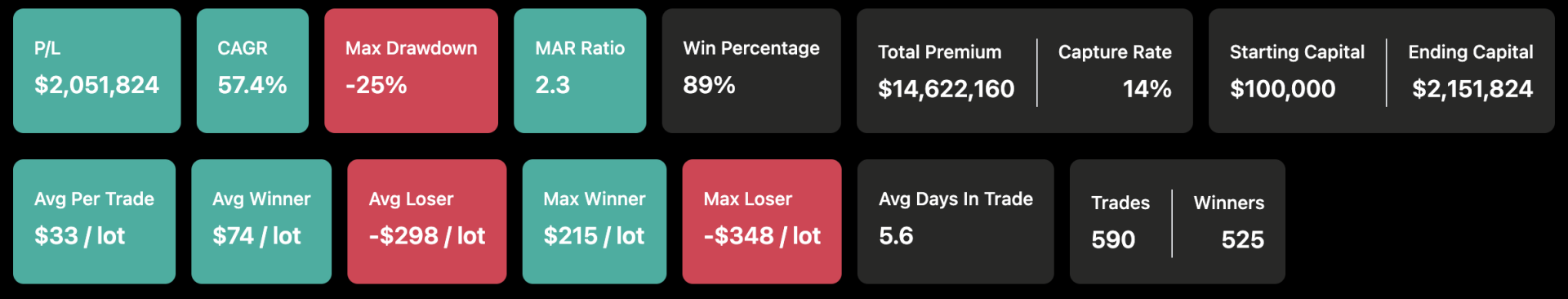

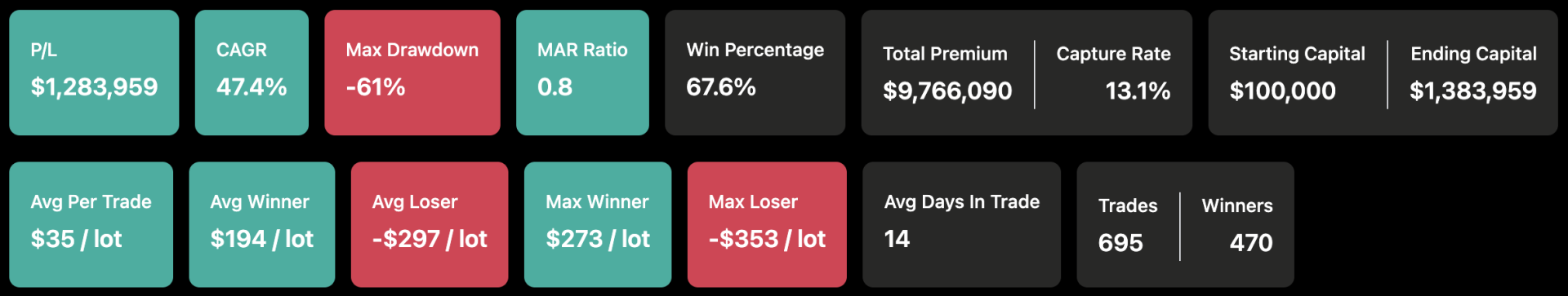

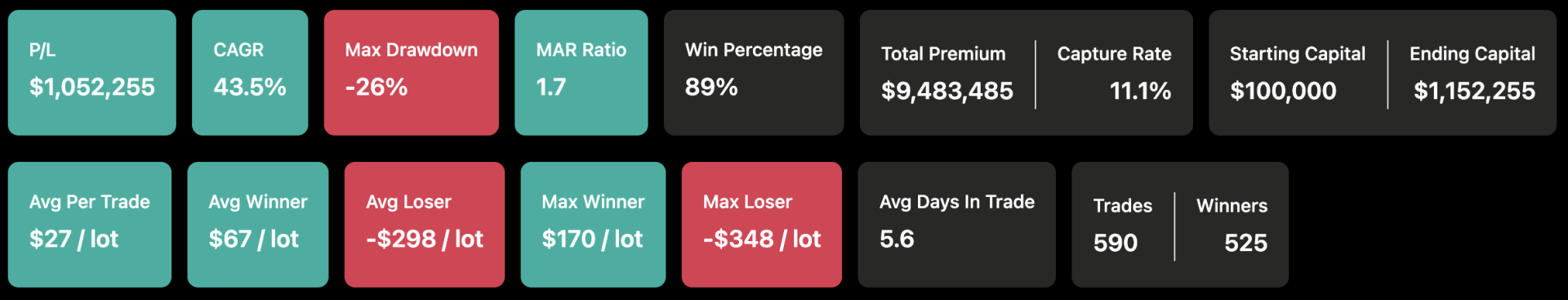

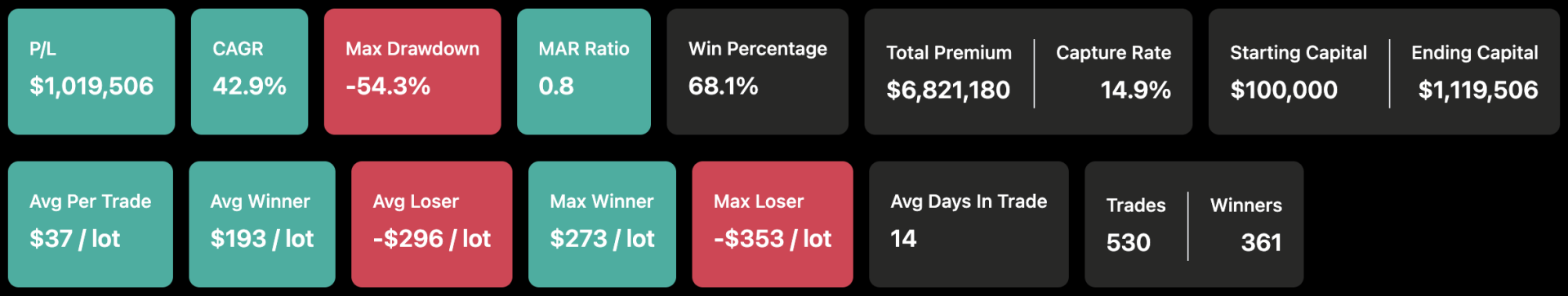

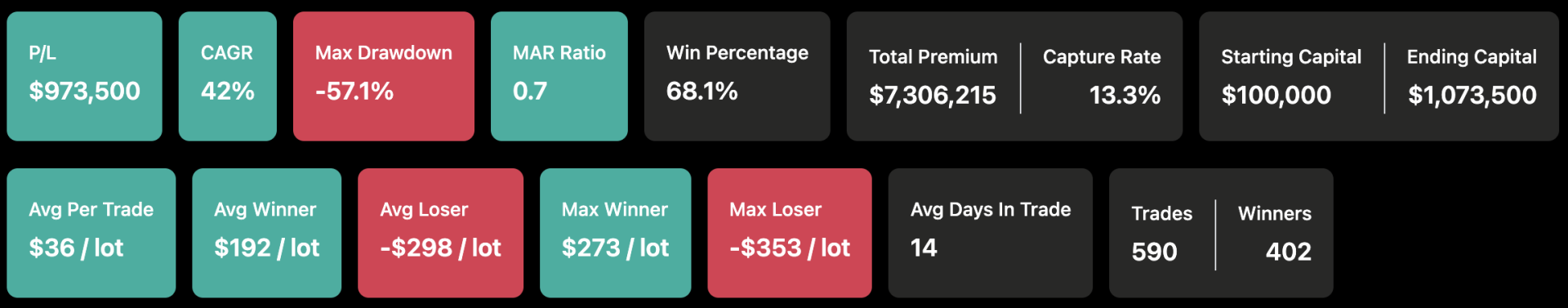

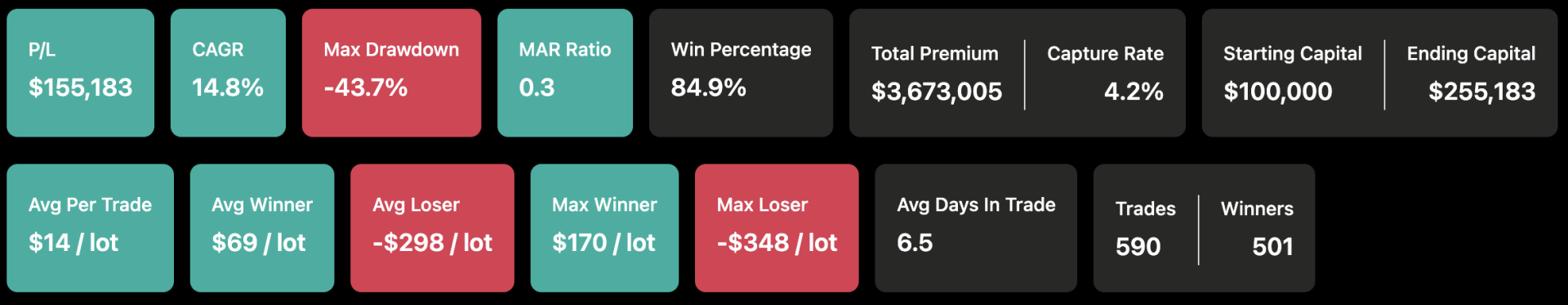

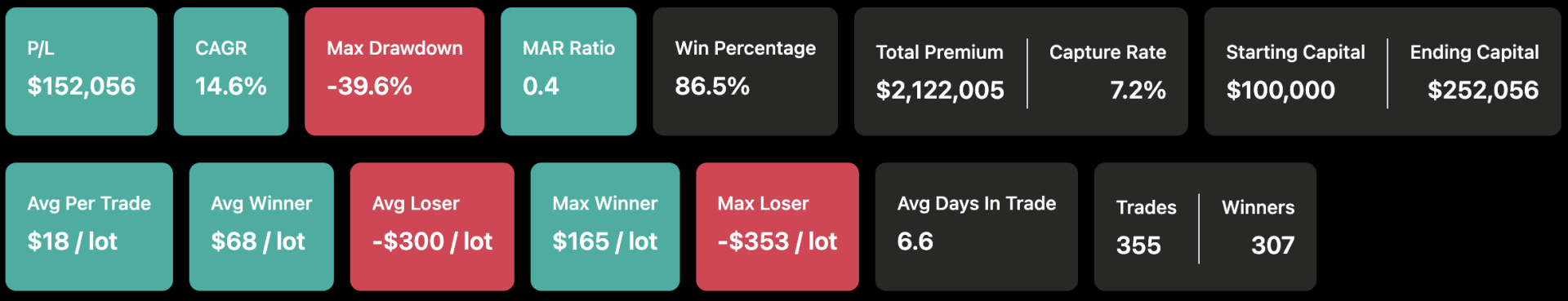

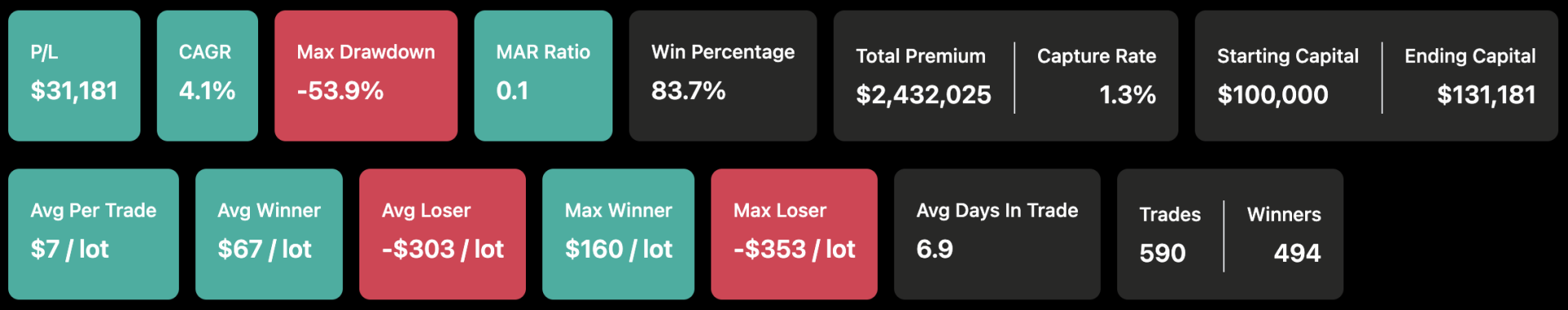

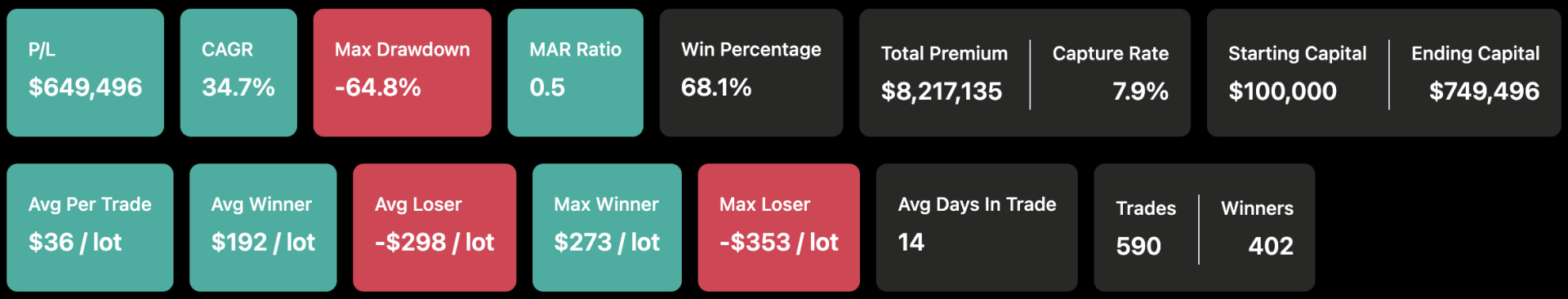

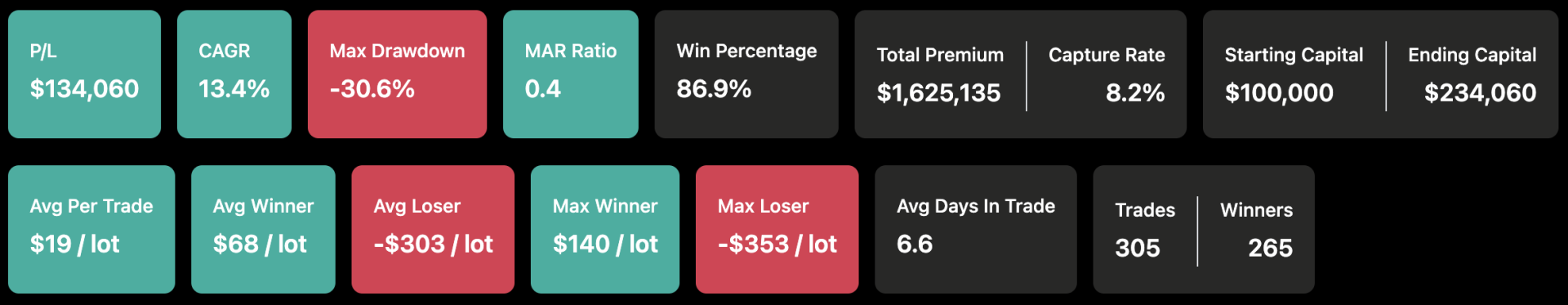

Backtested in various market types, this strategy has made money every year since 2017. Surprisingly, 2020 was one of the best years despite the COVID crash.

I'm even working on automating this strategy its so easy to execute, but will share more on that with those who take the course.

Look, it's time to put down the option trading books and start trading and this is a great place to start.

Let's get your money working for you and I'll see you on the inside.

Variations Shown During Course

Course Lessons

Eric O'Rourke

I help options traders stay green by using probabilities and risk management. Email: Eric@StockMarketOptionsTrading.net